modified business tax nevada due date

Download or print the 2021 Arizona Form 140 Instructions Income Tax Instruction Packet for FREE from the Arizona Department of Revenue. If fully built out the building will have the.

Floridas corporate income tax rate declined from 55 to 44458 percent in September 2019 effective for tax years 2019-2021.

. Gigafactory Nevada also known as Giga Nevada or Gigafactory 1 is a lithium-ion battery and electric vehicle component factory in Storey County Nevada. A BRIEF HISTORY OF THE BPOL TAX The Business Professional and Occupational License Tax is a local option tax on the privilege of doing business within a locality. The REIT generally elects to deduct start-up or organizational costs by claiming the deduction on its income tax return filed by the due date including extensions for the tax year in which the active trade or business begins.

The average local income tax collected as a percentage of total income is 013. FICTITIOUS BUSINESS NAME STATEMENT File No. 14870 HIGHWAY 4 STE A DISCOVERY BAY.

Merchant is not entitled to a deduction as it did not file a return for an income or income based tax in Nevada. Colorado adopted the following lodging excise tax proposal on August 23 2022 and the. You must file estimated tax returns on a quarterly basis if you are self employed or do not pay sufficient tax withholding.

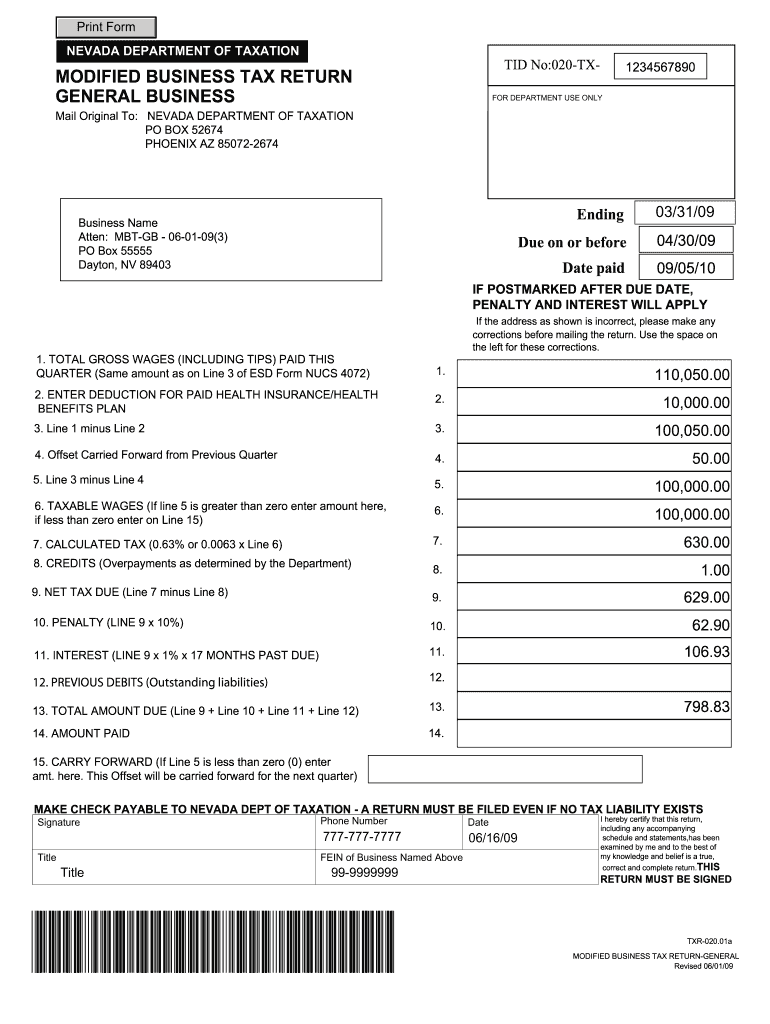

How you can complete the Nevada modified business tax return form on the web. The facility located east of Reno is owned and operated by Tesla Inc and supplies the battery packs for the companys electric vehicles except vehicles produced at Giga Shanghai. F-2022-0004654 The name of the business.

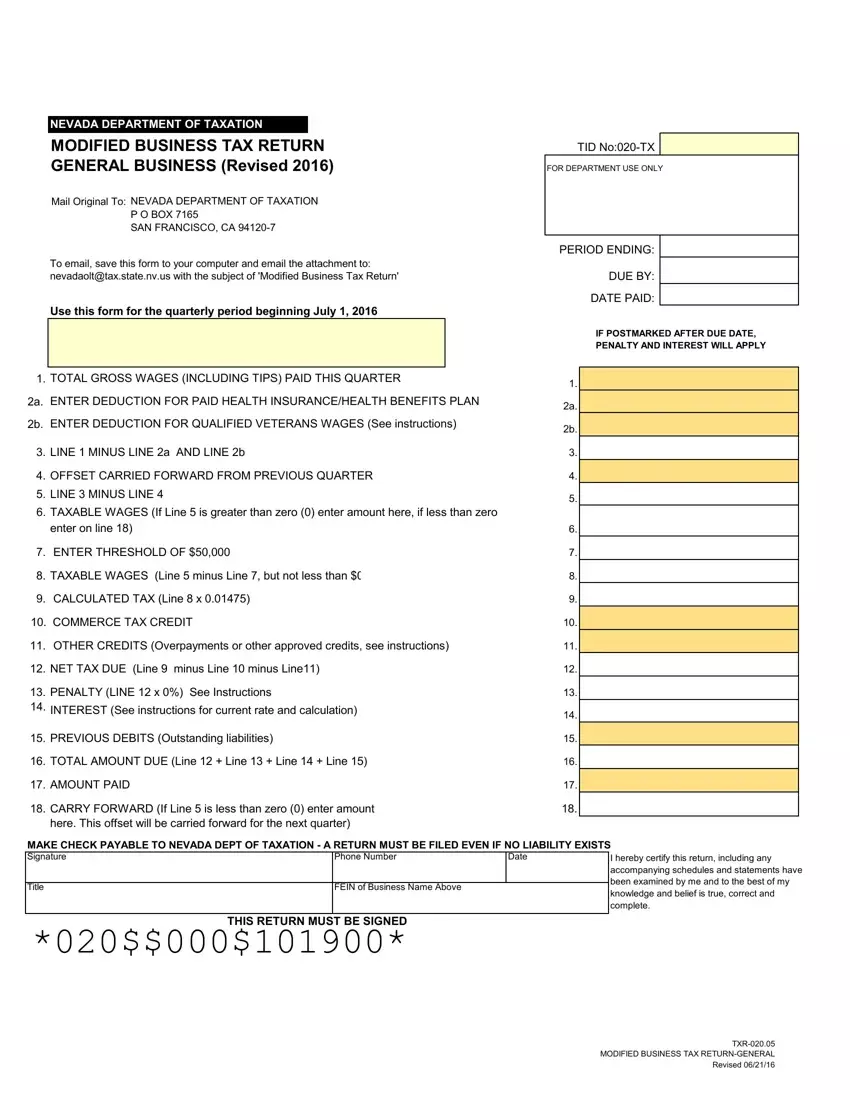

This program allows any taxpayer who is required to pay the Modified Business Tax pursuant to NRS 363A130 or 363B110 who makes a matching contribution to employees participating in a qualified Nevada College Savings Plan or the Nevada Higher Education Prepaid Trust Fund to receive a credit against the tax otherwise due. This online service can be used to make payments of Sales and Use Tax Modified Business Tax Live Entertainment Tax Governmental Services Tax Insurance Premium Tax Bank Excise Tax Liquor Tax Other Tobacco Tax and fees including Tire Recycling Fee and. The due dates are April 17 June 15 September 17 2012 and January 15 2013.

License tax Due date. If it was previously required you still need to be registered to do business with the Federal Government through the System for Award Management SAM. While the Michigan income tax brackets are not modified.

May 1 1995. Regarding the Annual Franchise Tax Form 3522 the 1st payment will have weird due date and then itll be April 15th every year after that. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed.

Sign Online button or tick the preview image of the blank. Use Schedule T Nonconsenting Nonresident Members Tax Liability to calculate and report NCNR members taxes the LLC must pay. To get started on the blank use the Fill camp.

Form D-30 is a District of Columbia Corporate Income Tax form. While some taxpayers with simple returns can complete their entire tax return on this single form in most cases various other additional. Improving Lives Through Smart Tax Policy.

Use this step-by-step guide to complete the Nevada modified business tax return form promptly and with excellent precision. If your return shows that you owe tax you must pay it by the due date of your return without regard to any extension to file to avoid late-payment penalties and interest. For calendar year 2021 pay by April 18 2022.

Notable Ranking Changes in this Years Index Florida. You may enroll in Nevada Tax automatically to file your returns in the future. Filing completed FTB 3832 or the single members consent or Schedule T does not satisfy the members California filing requirement.

For example if you formed your LLC this month on June 22nd your 1st payment paying for the 2017 tax year is due the 15th day of the 4th month after your LLC is formed. NRS 703025 704110 704185 704187 704210 Adjustment date means the end of the calendar year for an electric utility for the purposes of a deferred energy application or the end of the calendar month selected by a gas utility for the purposes of a deferred energy application or an annual rate adjustment application. For more details see the Instructions for Form 4562 Depreciation and Amortization.

BERRA GYRO Located at. The tax is due by the Form 568s original tax return due date. 94505 is hereby registered by the following owners.

GrantSolutions System Access and Training DOI financial assistance recipients received system access and training according to their awarding bureaus GrantSolutions deployment timeline.

How To Create A Chart Of Accounts In Construction Free Download

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Nevada Commerce Tax What You Need To Know Sage International Inc

Nevada Commerce Tax What You Need To Know Sage International Inc

The Top How To Minus Tax From Amount

Nevada Commerce Tax What You Need To Know Sage International Inc